still newbie here and learning as best as I can get.

The main difference is that with the core wallet you have control over your private keys = you really own the BTG in that wallet, but you need to properly backup your private keys because if you lose them and your PC get toasted you are basically screwed.

On the other hand, an exchange holds your keys and you need to trust them to secure your BTG, and as you don’t have your private keys with an exchange you don’t physically own your coins, what you have is the promise of the exchange to give you access to your funds, it is easy to use exchange but if it is hacked you are screwed.

#meetoo

So, the main difference, is that when you pay BTG, to another address, you really CAN’T choose your commission fee, on exchanges.

You have control over that, with a wallet. ![]()

Example of small fee, on an working exchange/bittumbler/something-of-the-likes:

You do need to distinguish between the transaction fee and the service fee.

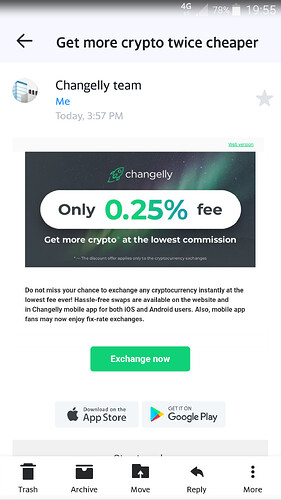

Using Changelly as an example:

Assume you want to swap between one coin and another. You need to send them Coin A, and they will send you Coin B.

-

When you send them Coin A, you must include a Transaction fee. Your wallet will automatically handle the TX fee for you. This fee does not go to Changelly; it goes to the miners.

-

Changelly performs the service of converting the coin to the other, most likely by using commercial exchanges. They charge you a service fee of 0.25% for this service.

-

Changelly send you Coin B. They must include the necessary TX fee to the miners for the transaction to go through.

It’s up to the service provider to choose their service fee, and it’s up to them whether or not they include the TX fee fro Coin B in their service fee - sometimes a service provider will charge you for the TX fee on top of their service fee. Always pay close attention to the list of fees to be sure.

For BTG, the fee is so low it doesn’t matter. (You can make dozens of transactions for a total cost of less than $0.01 in fees.) But for some coins, like Bitcoin, the TX fee can be substantial, especially when their chain is going through a congested (busy) period.

about that, I noticed that when the market’s at its most volatile, the difference between a BTC’s buy value, and its sell value, becomes substantial.

I figured that’s another way to deter volatility.

That’s called “the spread.” The difference between the highest offer to buy and the lowest offer to sell is a kind of “no man’s land.” In an efficient and liquid market, that spread is very small. But in an illiquid or inefficient market, the spread becomes larger.

It’s a way to infer liquidity, no volatility, per se… but indirectly, they are related. If there is poor liquidity, and a large market order comes in, it will eat up a lot of the offers.

A big market buy will eat up a lot of offers to sell, increasing the spread by raising the top figure.

A big market sell will eat up a lot of offers to buy, increasing the spread by lowering the bottom figure.

If liquidity is high, the spread doesn’t increase much - why?

- If there are very many offers out there, than the big order doesn’t cause as big a move.

- If there are lots of player in the market, then although the big order opens up the spread, it is immediately filled in by the many new offers that come in to fill the spread.

So… if spreads are large and persist for a long time after a big buy/sell, then liquidity is poor.

And if liquidity is poor, big buys/sells cause bigger changes is price ← this is volatility.

Wallet is totally a payment oriented application but based on Bitcoins.

On the other hand, Bitcoin exchange is different as it makes exchange literally (english meaning).

Both end include payment transations.

Interesting topic for me!