Good question… you’re effectively asking about each coin’s Inflation rate, which is a function of new coins being distributed via mining block rewards.

BTC, BTG, and BCH all have a 12.5 coin block reward and a target ten minute block time, and the same halving schedule… as a result, they should take roughly the same amount of time to mine to full Max Supply… over a hundred years (because of the halvings every four years.) They’re all at around 80% of Max Supply now.

Bitcoin Diamond chose to multiply everything by ten…so they have ten times the coin, but they also give out 125 coin as a block reward. (I couldn’t find that number on their web site, but looking at their block explorer, there are lots of blocks with exactly one transaction - and that one transaction is the block reward, so it’s easy to look up.) They kept the same 10 minute target and, as far as I know, they have the same halving schedule. As a result, they have roughly the same timeline and inflation as the other Bitcoin forks you’ve listed.

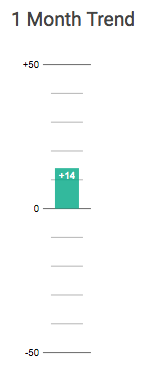

This inflation rate is currently around 3.8% annually, but will drop to half of that in roughly two years, assuming they all hit their ten-minute target (on average.)

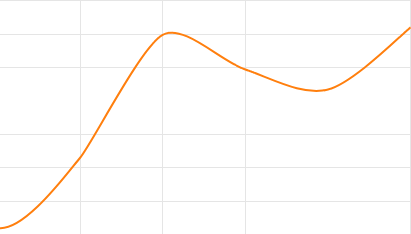

The Bitcoin Cash supply is a bit high because their Difficulty Adjustment Algorithm used to be… imperfect, resulting in a lot of excess blocks getting mined, which is why their Max Supply is higher than Bitcoin’s, even though both Bitcoin and the Bitcoin Cash fork had identical supplies on August 1st, and both targeted 10-minute blocks.

As of right now, BTC is at block height 519,925, while BCH is at 527,506. So BCH has mined 7,581 more blocks than Bitcoin since August 1st.

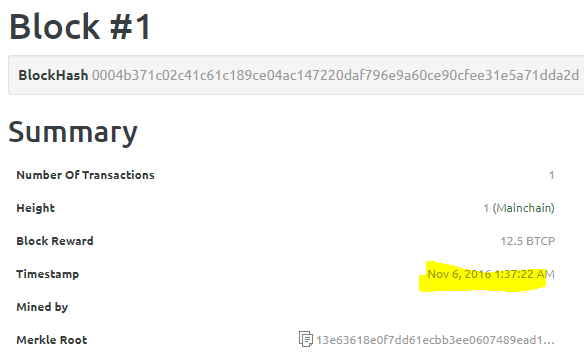

Bitcoin Gold’s block height is at 525,253, but doesn’t as easily correlate to Bitcoin… while the block height was identical to Bitcoins at the time of the fork on October 24, 2017, Bitcoin Gold didn’t begin to mine until November 12, because it was not a live coin split. And, on November 12, the first 8000 blocks mined were mined rapidly to form the BTG Endowment, which raised the block count and created 100,000 coins of supply as a one-time event on that day.

Bitcoin Diamond’s supply is the furthest out of whack - closer to 72% of max… But their block height is at 514,246. They seem to be way behind Bitcoin’s 519,925, despite only splitting off in December.

In the end, the blockheight, halving schedule, and reward scheduled mean that all four of these bitcoin forks are on roughly similar inflationary paths right now - but we can expect them to hit the next reward halving at different dates in about two years, depending on average block times - and, unless things change with their hashing network, Bitcoin Diamond may lag behind.

It’s worth noting that other Bitcoin forks, like Litecoin, are at different stages of the halving cycle. All the Bitcoin forks above copied the Bitcoin blockchain back to 2009, and are far along the halving schedule… but Litecoin started from scratch in late 2011, so they are about three years younger - and provide double the rewards of these current Bitcoin forks. As a result, Litecoins inflation rate is a little over 9%. Litecoin’s current supply is just under 67% of max, and their reward (and inflation rate) will be halved in just over 1 year from now.

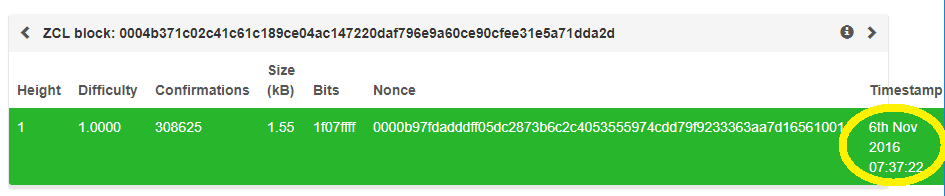

An even newer coin, such as ZCash, can have dramatically higher inflation; ZCash supply is under 18% of max, and the annual inflation rate is somewhere around 70% - but again, that’s because it’s so young, its first block being in late 2016.

If you’re looking for an inflation hedge, you should prefer a coin like BTC, BCH, or BTG, even if you believe in the ZCash project. Otherwise, from an investment perspective, you’d want to look at things other than inflation - ZCash is very different from the other coins discussed here, being a privacy-focused coin, so it has very different potentials and possibilities.